If you work in a tech startup, you probably have some options. If you work(ed) at a successful startup, you know that when the day comes that you exercise and sell your options, you get to pay income tax on the difference between the low strike price you paid vs the high market price the stock are actually worth.

For a growing startup the value of the options will increase. This presents a tax optimization oppotunity. If you can afford it, you can decide to exercise (buy) your options as early as possible. You would then have to pay the income tax, but the upside is you are done with it. When the startup later IPOs and you can sell your stock, you pay capital gains tax, which is usually a lower percentage.

Some startups also allow for a method called early exercise of options, where you can technically exercise your options even before they vested. These same calculations will apply for that scenario too.

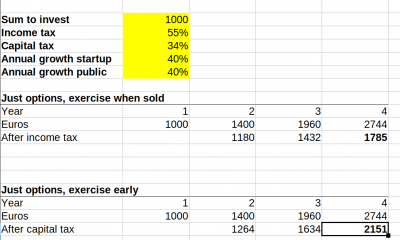

Comparing early exercise vs exercise at sale

Attached is a spreadsheet I created to calculate the benefit of exercising options early vs holding your options until you want to sell them and then you exercise and sell the same day. Note that a pre-condition to choose the former option is that you have some spare cash that you can spend on buying your options AND paying for the income tax caused by it.

Both the value of your options and the (marginal) taxes in each country will of course wary a lot, but above is one example where I imagine you have options worth of 1000 EUR and you estimate your startup will grow 40% YoY.

We can see that if you exercise and pay the income tax in the first year, then by year 4 when you actually sell the stock you will benefit 366 EUR by then paying the lower capital gains tax.

Seems like a no-brainer?

Opportunity cost

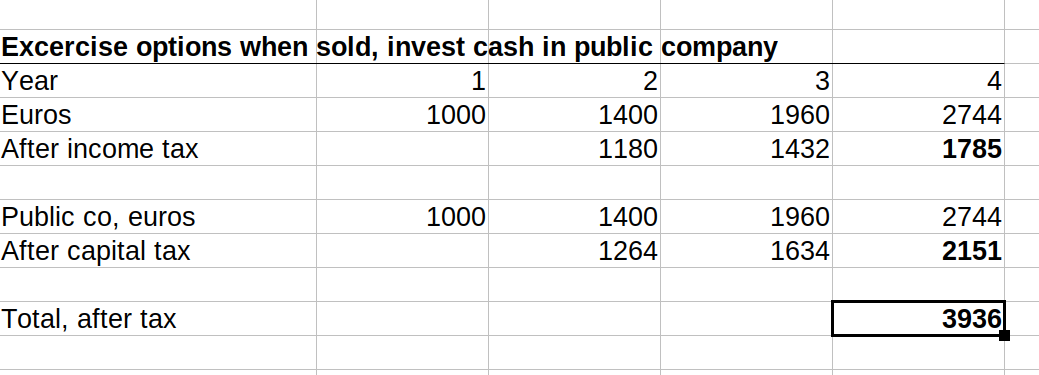

What the above calculation misses is an example of opportunity cost. If you actually have 1000 EUR to spare, you can freely invest it in any other company too. This must be taken into consideration.

Let's assume that although your startup isn't public, there are other public companies with similar risk profile, maybe in the same industry. For example, and engineer working for SpaceX could consider the option to invest in Virgin Galactic, because based on their intimate knowledge of the space travel industry they estimate that both companies offer the same expected future value. Of course, the SpaceX engineer could invest the 1000 EUR in any other asset as well, including bitcoin, real estate, etc...

The remarkable realization of this alternative is that you now essentially own 2000 EUR worth of assets! You already have 1000 EUR worth of options, and you invest your spare 1000 EUR in some other stock. It turns out this is in most scenarios the most beneficial strategy, even if you also end up paying more tax.

Your net benefit with this strategy is now 3936 EUR when selling all stock in year 4! (Or, 2936 if we want to subtract the original 1000 EUR first.) This is much better than either of the two alternatives above.

Even if you don't assume the same growth percentage for the startup and the public company, this third option is still the optimal choice for a wide range of case. This is because you essentially invest 2000 EUR instead of 1000 EUR.

Conclusion

As a conclusion, if you have cash with which you could buy the options granted by your employer, it may make sense to invest that cash in a separate stock instead.

(Note that if you are offered to buy new stock in a startup, employer or not, then that is a different scenario altogether. The above analysis only applies to options.)

- Log in to post comments

- 483 views